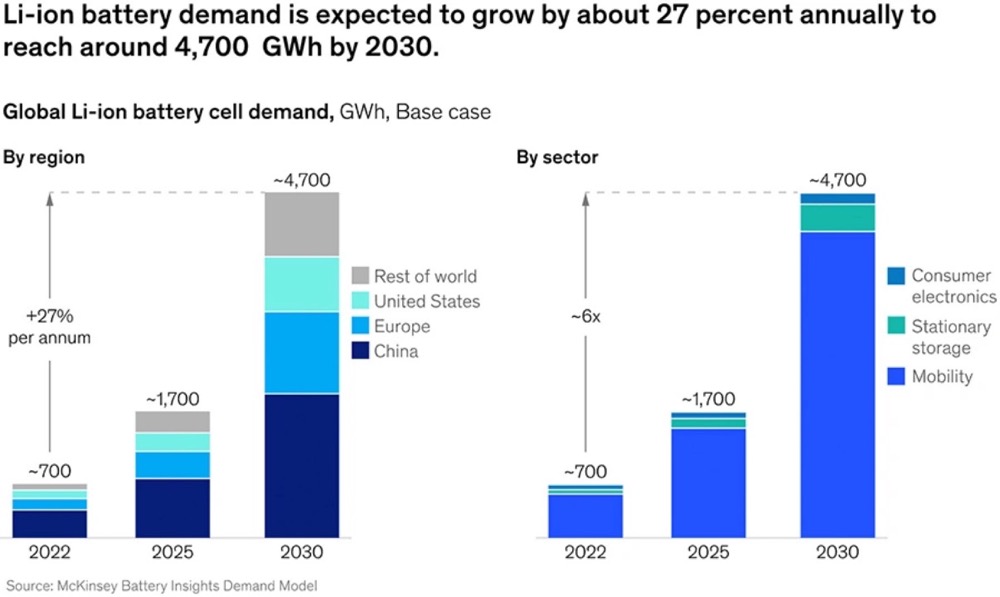

Li ion battery suppliers worldwide have achieved power-battery installations reaching approximately 504.4 GWh during the first half of 2025, marking a 37.3% increase year-over-year. Global lithium battery industry demand continues its trajectory from 471 GWh in 2021 toward a projected 3,939 GWh by 2028, representing a 31% CAGR.

Li ion battery suppliers worldwide have achieved power-battery installations reaching approximately 504.4 GWh during the first half of 2025, marking a 37.3% increase year-over-year. Global lithium battery industry demand continues its trajectory from 471 GWh in 2021 toward a projected 3,939 GWh by 2028, representing a 31% CAGR.

China maintains its position as the dominant manufacturing center among top lithium ion battery manufacturers, accounting for approximately 58.5% of global installations (295.2 GWh, +48.8% YoY). Overseas markets have reached approximately 209.2 GWh, growing at 23.8% year-over-year. Companies that make lithium batteries continue capitalizing on the technology’s exceptional energy density, enabling the production of smaller, thinner, and higher-capacity power solutions.

With 15 years of experience as custom battery manufacturers, we have observed how lithium-ion batteries have fundamentally altered portable electronics, electric vehicles, and energy storage systems. CATL currently leads among li ion battery suppliers, producing 96.7 GWh globally—a 167.5% annual increase. Established players like Panasonic continue strengthening their market position through innovations including new battery technologies for industry leaders such as Tesla.

Electrical engineers, product designers, and procurement specialists working within this rapidly evolving landscape require critical insights about supplier selection, emerging technologies, and industry knowledge that develops only through decades of hands-on experience. This guide provides that essential information based on our extensive work with battery technology across multiple industries and applications.

Global Lithium Battery Market in 2025: Key Trends and Forecasts

Image Source: Market.us

Image Source: Market.us

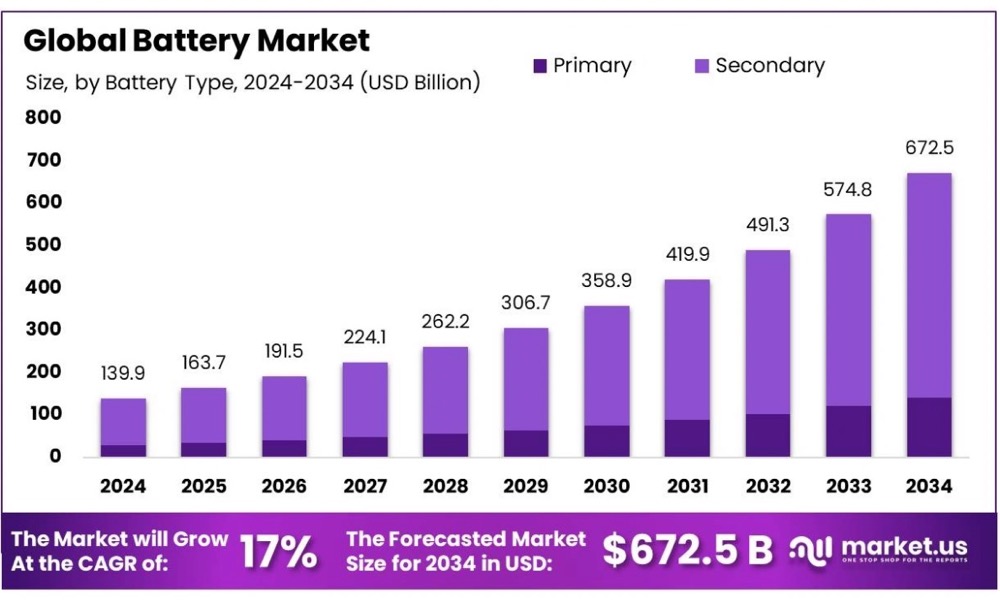

The global lithium-ion battery market has reached a critical inflection point in 2025. Currently valued at USD 194.66 billion, the market projects growth to USD 426.37 billion by 2033, representing a 10.3% CAGR. This expansion fundamentally reshapes supply chains and creates new opportunities for innovative battery solutions across multiple industry segments.

EV and ESS demand growth by region

Electric vehicle adoption drives the primary demand for lithium battery capacity. The EV battery market projects growth from USD 67.51 billion in 2024 to USD 405.3 billion by 2033—a 19.9% CAGR. Automotive applications held 67% of the lithium-ion battery market in 2024 and are predicted to exceed USD 225 billion by 2034.

Regional growth patterns demonstrate distinct market dynamics:

Asia Pacific maintains its dominant position, accounting for the largest share of lithium-ion battery demand in 2025. The region’s market projects growth to USD 141.5 billion by 2034, driven by EV adoption and supportive government policies.

North America faces a supply transition from undersupply of approximately 50 GWh in 2025 to projected oversupply by 2030. This shift reflects aggressive capacity expansion efforts, although the upstream supply chain for active materials remains underdeveloped.

Europe confronts ongoing supply constraints with an expected lithium-ion battery undersupply of approximately 70 GWh in 2025. However, significant investments in gigafactories across Germany, Poland, and Hungary are expanding the continent’s production capacity.

The energy storage system (ESS) market projects growth from USD 8.6 billion in 2025 to USD 41.8 billion by 2032, at a 25.2% CAGR. BloombergNEF expects global energy storage additions to grow 35% this year, establishing a record with 94 gigawatts (247 gigawatt-hours) of new capacity.

Shift in chemistry dominance: LFP vs NMC

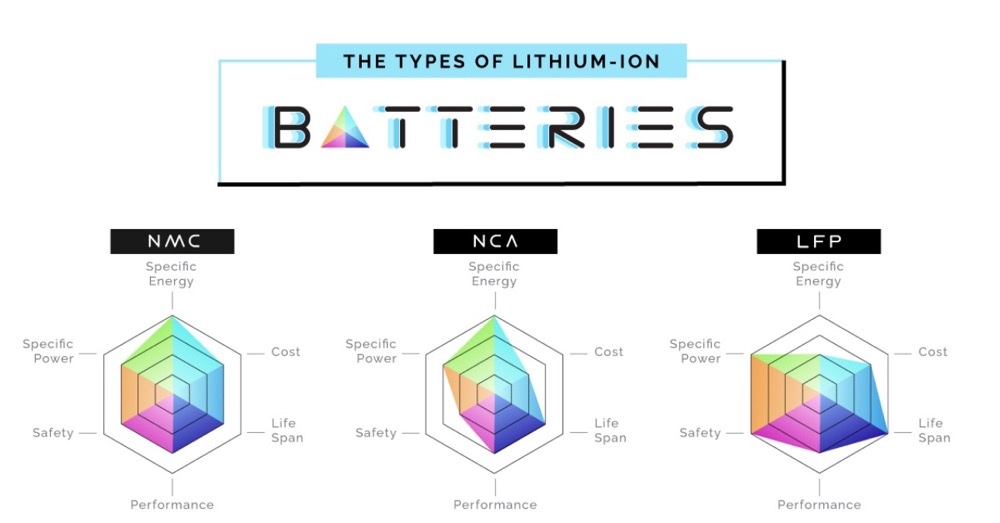

The most significant trend reshaping the industry involves the rapid shift in battery chemistry selection. NMC (nickel manganese cobalt) batteries currently dominate with approximately 60% market share, while LFP (lithium iron phosphate) batteries gain ground at around 30%.

McKinsey projections indicate LFP’s global share could reach approximately 44% by the end of 2025. This shift appears particularly pronounced in China, where passenger EVs with LFP technology increased from 45% in 2021 to 60% by 2023.

Several factors drive this chemistry transition:

Cost efficiency – LFP batteries require significantly lower production costs than NMC alternatives Safety advantages – LFP’s higher ignition point reduces thermal runaway risks

Supply chain security – LFP utilizes abundant materials like iron and phosphate rather than scarce cobalt Performance improvements – Recent innovations have narrowed the energy density gap between LFP and NMC batteries

This trend creates opportunities for custom battery manufacturer applications where moderate energy density proves acceptable. ESS projects increasingly utilize LFP chemistry, delivering excellent cycle life at substantially reduced costs.

Top lithium ion battery manufacturers by GWh output

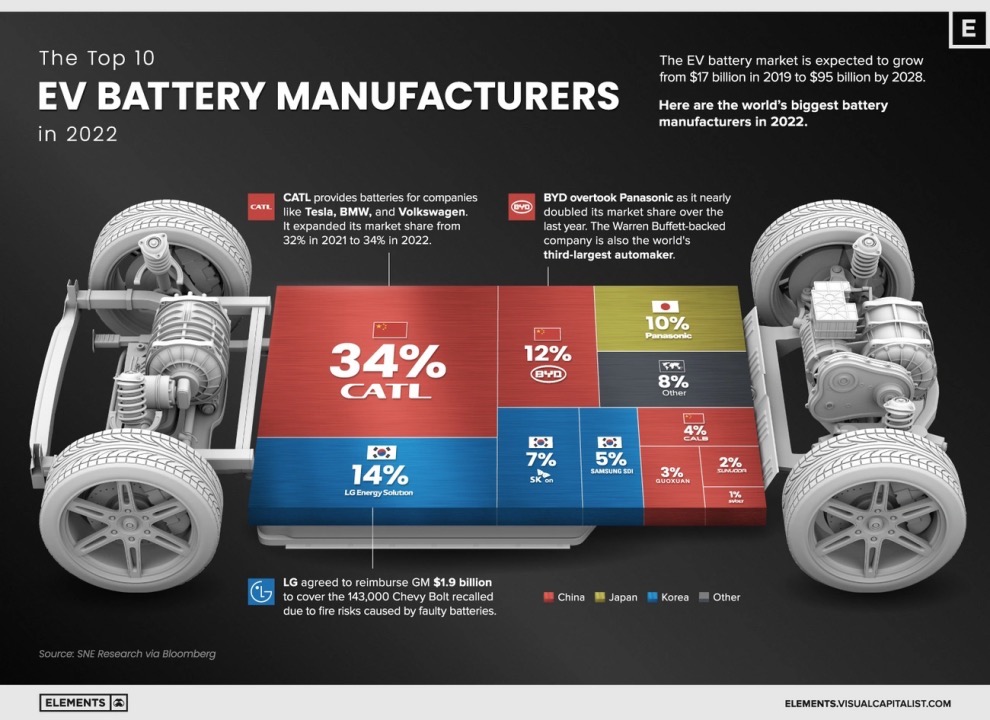

The competitive landscape among li ion battery suppliers consolidates around dominant players. Global production volume reached approximately 750 gigawatt-hours (GWh) in 2023, with five companies controlling significant market share:

CATL (China): Leading producer with approximately 243.3 GWh, supplying major automakers including Tesla, BMW, and Volkswagen

BYD (China): Produced approximately 117 GWh, powering both proprietary vehicles and other manufacturers

LG Energy Solution (South Korea): Production volume of 106.8 GWh, serving clients such as General Motors, Hyundai, and Volkswagen

Panasonic (Japan): Contributed approximately 55.8 GWh, primarily supplying Tesla’s EVs

SK On (South Korea): Delivered 40.8 GWh to various automakers

These top lithium battery companies drive innovation through substantial investments in new technologies and expanded production capacity. Strategic partnerships with major cell producers have become essential to secure supply chain stability for specialized applications requiring custom battery solutions.

Battery Chemistry Breakdown: LFP, NMC, LTO and Their Use Cases

Image Source: Elements by Visual Capitalist

Image Source: Elements by Visual Capitalist

Battery chemistry selection determines the fundamental performance characteristics of any custom battery solution. The type of battery required is determined by the requirements of the device being powered: device voltage, load-current, and recharge time requirements; environmental considerations; physical space available; weight constraints; and regulatory and transportation requirements. Each chemistry family offers distinct advantages and limitations that directly impact application suitability.

LFP: Safety and cost for ESS and RV

Lithium Iron Phosphate (LFP) batteries provide exceptional safety characteristics through their strong iron-phosphate bond structure, which enhances electrochemical stability and prevents breakdown under normal charge/discharge conditions. The chemistry’s inherent thermal stability makes these batteries remarkably resilient against thermal runaway events.

LFP batteries typically deliver 2,000+ charge-discharge cycles while maintaining structural integrity. This extended lifecycle translates into lower total cost of ownership, particularly for applications requiring frequent cycling. LFP cells can be safely charged to 100% capacity on a regular basis without significant degradation—a notable advantage over other chemistries.

The chemistry excels in recreational vehicle applications due to:

- Superior thermal stability compared to alternatives

- Extended service life often exceeding 3,000 cycles at 100% DOD

- Weight reduction of approximately 58% compared to equivalent lead-acid batteries

- Robust performance in challenging environmental conditions

For stationary storage systems, LFP chemistry provides the optimal balance of safety, longevity, and cost-effectiveness. The protection circuits are contained in what is commonly referred to as the protection circuit module (PCM), which manages the basic safety functions while maintaining the inherent stability advantages of the iron-phosphate chemistry.

NMC: High energy density for EVs

Nickel Manganese Cobalt (NMC) batteries deliver exceptional energy density performance for applications requiring maximum capacity within size constraints. Energy density values typically range from 150-250 Wh/kg, with advanced formulations exceeding 300 Wh/kg under optimal conditions. This chemistry enables longer driving ranges in compact form factors essential for electric vehicle applications.

The latest NMC 811 formulation (80% nickel, 10% cobalt, 10% manganese) achieves energy density up to 320 Wh/kg. This represents a significant advancement that directly translates to extended vehicle range and reduced weight. A 1kg NMC 811 battery can power a 10W device for over 27 hours.

NMC chemistry demonstrates superior performance in:

- Electric vehicles requiring maximum range capability

- Portable electronics needing high capacity within limited space

- Power tools demanding both energy density and high discharge rates

However, NMC batteries present certain limitations. The chemistry exhibits reduced thermal stability compared to LFP, requiring sophisticated battery management systems to ensure safe operation. Cycle life typically ranges from 500-1,000 cycles compared to other chemistries, making it less suitable for applications requiring frequent cycling.

LTO: Fast charge and long cycle life

Lithium Titanate Oxide (LTO) batteries represent a specialized solution for applications requiring ultra-rapid charging and exceptional longevity. The chemistry employs lithium titanate anodes instead of conventional graphite, creating a unique surface area of approximately 100 square meters per gram compared to graphite’s 3 square meters per gram. This expanded surface area allows electrons to enter and exit the anode with remarkable speed.

LTO technology delivers extraordinary cycle life performance. These batteries endure over 20,000 charge-discharge cycles with minimal degradation—approximately 10 times longer than standard lithium-ion batteries. Some LTO cells demonstrate retention of 80% capacity even after 20,000 cycles, making them ideal for applications where replacement is difficult or costly.

Ultra-fast charging capability represents another key advantage, with full charge times as short as 10-15 minutes. Toshiba’s SCiB cells achieve 0-80% charge in one minute at 48°C, demonstrating the technology’s rapid energy acceptance capability.

These advantages come with trade-offs in energy density and weight. LTO batteries deliver 60-90 Wh/kg compared to NMC (160-270 Wh/kg) or LFP (100-180 Wh/kg). Weight considerations are significant—an LTO pack might weigh 770kg versus an NMC pack at 300kg for equivalent applications.

LTO chemistry excels specifically in applications requiring:

- Public transportation systems needing rapid charging between routes

- Grid stabilization applications demanding frequent cycling

- Military equipment operating in extreme temperatures (-30°C to 55°C)

The faster you discharge or the lower the temperature, the lower the capacity of a battery. This relationship becomes particularly important when selecting between chemistries for specific operating conditions and performance requirements.

Top 5 Li Ion Battery Suppliers to Watch in 2025

Image Source: Elements by Visual Capitalist

Image Source: Elements by Visual Capitalist

The competitive landscape among li ion battery suppliers continues to evolve through technological breakthroughs and strategic market positioning. Our experience working with various battery manufacturers over the past 15 years has provided insight into how these industry leaders influence everything from material availability to custom design possibilities. The following five companies are making the most significant impact on the global battery supply chain.

-

CATL: Global leader in EV batteries

CATL has maintained its position atop the global EV battery market for seven consecutive years. The company’s 2023 battery consumption reached 259.7 GWh, representing a 40.8% year-over-year increase and securing a 36.8% market share—nearly 21% ahead of their closest competitor. CATL remains the only battery manufacturer worldwide with over 30% market share.

The company’s success stems from continuous innovation, particularly with their Qilin Battery and Shenxing Superfast Charging Battery technologies. Political challenges in the US market, where they’ve been blacklisted by the Defense Department over alleged military ties, have not slowed their global expansion. CATL raised $4.6 billion in their 2025 Hong Kong listing, with most funds directed toward a $7.3 billion factory in Hungary, strengthening their European operations with key customers including BMW, Stellantis, and Volkswagen.

-

LG Energy: US expansion and Tesla partnership

LG Energy Solution has secured a $4.3 billion agreement with Tesla to supply US-built lithium iron phosphate batteries from 2027 through 2030. This partnership positions LG as Tesla’s primary domestic battery supplier following increased US tariffs on Chinese battery imports.

The agreement includes options to extend the supply period by up to seven additional years based on Tesla’s future requirements. As the only major producer of LFP batteries in the United States, LG began production at their Michigan plant earlier this year and is converting some EV battery lines to energy storage production in response to surging demand from data centers.

-

Panasonic: Solid-state battery innovation

Panasonic continues its battery technology development, recently showcasing their high-performing 2170 cylindrical lithium-ion cells in the Lucid Gravity Grand Touring. These cells achieve an energy density exceeding 800Wh/L, representing significant engineering advancement. By December 2023, Panasonic had supplied approximately 15 billion lithium-ion EV batteries globally without a single vehicle recall due to battery-related issues.

Despite industry interest in solid-state technology, Panasonic’s leadership has expressed measured skepticism. CTO Tatsuo Ogawa believes solid-state batteries will remain a “niche” product better suited for applications like drones and power tools rather than becoming mainstream in automotive applications. Panasonic maintains development programs in this area, including through a joint venture with Toyota.

-

Samsung SDI: ESS and commercial vehicle focus

Samsung SDI has shifted toward commercial vehicle applications and energy storage systems amid slowing EV sales. The company recently unveiled their LFP+ battery featuring 10% higher energy density than conventional LFP batteries. Their enhanced electrode technology enables impressive durability—sufficient for over 1,400 round trips between Hanover and Frankfurt—while their proprietary No Thermal Propagation technology enhances safety critical for commercial applications.

Samsung SDI is advancing their All Solid Battery (ASB) technology featuring proprietary anode-less design. After completing what they describe as the world’s largest pilot production line for solid-state batteries in 2023, they plan to begin mass production in 2027. For nearer-term growth, they’re launching 46-phi cylindrical batteries for micro-mobility applications in early 2025.

-

BYD: Blade battery and sodium-ion roadmap

BYD, the world’s largest EV manufacturer, has launched what they describe as the “world’s first high-performance” sodium-ion battery energy storage system—the MC Cube-SIB ESS. Using their proprietary Long Blade Battery with a CTS super integrated design, this system offers enhanced safety standards and flexible module design.

The most significant advantage of BYD’s sodium-ion approach is cost reduction. Sodium’s natural abundance and improved fire safety characteristics should ultimately provide cheaper alternatives to lithium-ion once manufacturing scales up. The technology’s main limitation is energy density—BYD’s new product packs only 2.3MWh per 20-foot container, substantially less than the 5MWh standard for lithium-ion systems.

BYD has demonstrated commitment to this technology by beginning construction of a 30GWh sodium-ion battery plant in Xuzhou City, representing a $2.25 billion investment. Our experience as custom battery manufacturers suggests this development could eventually provide more affordable options for specific client applications where energy density requirements are moderate.

Emerging Lithium Battery Companies Gaining Ground

Image Source: Blackridge Research & Consulting

Image Source: Blackridge Research & Consulting

Several emerging lithium battery companies are rapidly gaining market share through strategic partnerships and technological innovation. These companies are increasingly becoming viable options for specialized applications, particularly for custom battery solutions requiring specific performance parameters.

SVOLT: BMW and Stellantis partnerships

SVOLT Energy Technology has secured a major agreement to supply lithium-ion batteries for Stellantis’ electric vehicles starting in 2025. The partnership covers battery cells, high-voltage storage systems, and battery management solutions. SVOLT will source cells from both Chinese plants and their European facility under construction in Saarland, Germany—a €2 billion ($2.40 billion) investment with planned annual output of 24 GWh.

SVOLT’s cobalt-free NMx cells feature 75% nickel and 25% manganese cathode materials with energy density reaching 240-245 Wh/kg. The company aims to expand from 12 GWh capacity in 2021 to 200 GWh by 2025 through multiple gigafactory projects. This expansion represents a significant scaling challenge that will test their manufacturing capabilities and supply chain management.

Large Power: Solid State and Extreme Environment/Explosion Proof Battery Tech – Custom Battery Manufacturer

Since our establishment in 2002, Large Power has built a reputation on delivering the impossible:

- 180 Million+battery modules successfully delivered

- 9,000+custom projects completed

- 86patents and copyright registrations

- 20+industries served globally

- 23 Yearsof continuous innovation

But these aren’t just statistics—they represent lives saved, missions accomplished, and innovations powered. Each project tells a story of a unique challenge solved, a specific need met, and a client who chose customization over compromise.

What truly sets us apart isn’t just our manufacturing capabilities—it’s our approach to problem-solving. While competitors offer catalogs of standard batteries, we offer something far more valuable: solutions designed from the ground up for your specific application.

EVE Energy: Energy storage growth

EVE Energy has established itself as a formidable player in the energy storage sector with shipments surging 133% year-on-year to 20.95 GWh in the first half of 2024. The company has achieved mass production of the industry’s first 628Ah large-capacity battery cell “Mr.Big”, demonstrating advantages in system security and economy.

The company’s 60GWh super energy storage factory represents the largest single energy storage facility in the industry. At peak operation, this facility can produce over 40 containers of 5MWh each day and deliver 1GWh output in just five days. EVE Energy’s international expansion includes factories in Hungary, Malaysia, and the United States.

Gotion: Global expansion and VW collaboration

Gotion High-Tech secured a partnership when Volkswagen acquired a 26% stake for approximately €1.1 billion, making VW their largest shareholder. The collaboration includes Gotion serving as technology partner for the cell factory layout at Volkswagen’s Salzgitter plant, with production scheduled to begin in 2025.

The partnership encompasses development of Volkswagen’s first generation of unified cells—prismatic cells adaptable to various chemistry mixes. Gotion is currently in the process of becoming a certified Volkswagen Group battery supplier in China.

SK On: BlueOval SK and Ford JV

SK On and Ford Motor Company established BlueOval SK, a joint venture building what they describe as the largest battery production operation in the United States. The partnership includes construction of new manufacturing sites in Kentucky and Tennessee, representing a planned $5.80 billion investment.

The facilities will be capable of producing up to 43 gigawatt hours each for a combined 86 gigawatt hours annually. The Department of Energy granted BlueOval SK a record $9.63 billion loan through its Advanced Technology Vehicles Manufacturing Loan Program in December 2023—the largest ever provided by this program.

Certifications and Safety Standards You Must Verify

Image Source: Tritek battery

Image Source: Tritek battery

Reliable li ion battery supplier selection demands thorough verification of safety certifications. Our experience designing custom battery packs over two decades demonstrates that certification compliance determines the difference between project success and catastrophic failure.

UN38.3, UL 1973, UL 9540A, IEC 62619

UN38.3 certification is mandatory for lithium batteries transported via air, sea, or land. This standard includes eight critical tests (T1-T8) simulating transportation hazards: altitude simulation, thermal cycling, vibration, shock, short circuit, impact, overcharge, and forced discharge. Batteries cannot be shipped internationally without UN38.3 certification.

UL 1973 serves as the cornerstone safety standard for stationary energy storage systems. This certification ensures battery systems can withstand overcharging, short-circuiting, and environmental stresses. UL 1973 testing evaluates cell consistency, vibration resistance, and ingress protection ratings.

UL 9540A addresses thermal runaway propagation, determining whether a single cell failure can trigger system-wide fires. This certification has become essential for installations near populated areas or regions prone to wildfires.

IEC 62619 certification covers safety standards for rechargeable lithium batteries in applications like UPS systems and energy storage. Testing includes overcharge protection, thermal stability, and mechanical abuse resistance.

Why Certification Matters for ESS and Transport

Energy storage systems require proper certification to ensure operational safety and legal compliance. Certified systems prevent project suspension due to noncompliance and achieve insurance underwriting eligibility. Major utilities and engineering contractors generally refuse to consider uncertified products.

Certified batteries dramatically reduce shipping risks. The UN38.3 standard verifies batteries can withstand extreme transportation conditions without leaking, catching fire, or exploding. Since January 2022, manufacturers must make test summaries available throughout the supply chain.

How to Request and Audit Test Summaries

Recent regulatory updates have standardized test summary requests. Under CFR § 173.185(A)(3), manufacturers and distributors of lithium cells manufactured after January 2008 must provide test documentation upon request. These summaries must include specific elements:

- Manufacturer’s contact information

- Test laboratory details and report identification

- Cell/battery description with specifications

- List of tests conducted with pass/fail results

- Reference to applicable standards

- Signature of responsible person verifying validity

Our practice includes maintaining systematic records of all certification documentation. This approach has prevented regulatory complications and project delays for clients across multiple applications.

How to Evaluate a Li Ion Battery Supplier in 2025

Image Source: Quality Magazine

Image Source: Quality Magazine

Evaluating potential li ion battery suppliers requires a systematic approach focusing on three critical areas. Mission-critical applications demand rigorous assessment frameworks that eliminate risk while ensuring optimal performance across the battery’s operational lifecycle.

Chemistry fit for your application

Application requirements must be clearly defined before engaging with lithium battery companies. Different sectors—medical devices, robotics, security systems—demand unique battery solutions. A comparative analysis of chemistry options against operational requirements provides the foundation for supplier discussions:

| Chemistry | Cost ($/kWh) | Cycle Life | Energy Density (Wh/kg) |

| LFP | 120 | 4000 | 160 |

| NMC | 150 | 2000 | 220 |

| LTO | 200 | 7000 | 90 |

This evaluation framework matches budget and performance requirements with appropriate chemistry selections. Medical equipment applications typically require the superior safety profile of LFP chemistry, while robotics applications may necessitate NMC’s higher energy density capabilities.

ODM capabilities and customization

Original Design Manufacturers (ODM) design and manufacture products according to client specifications, providing tailored battery solutions. ODM capability assessment should examine:

- Experience and reputation within the LiFePO4 battery industry • Customization capabilities for specific design requirements

• Compliance with relevant industry standards

Qualified ODM partners can customize voltage, capacity, form factor, and integrate advanced battery management systems. Case studies from comparable projects verify technical expertise and design flexibility. The supplier’s ability to scale from prototype through production volumes represents a critical capability assessment factor.

Lead times, warranty, and after-sales support

Quality suppliers provide comprehensive after-sales support including technical expertise, diagnostic tools, and usage guidance. Warranty verification should encompass:

- Performance warranties ensuring specific capacity maintenance (typically 70-80% after 10 years or 6,000 cycles) • Coverage for manufacturing defects in cells, casings, and components • Service and replacement terms during warranty periods

Warranty terms require thorough review for clauses that might void coverage under normal operating conditions. Supplier financial stability assessment is critical—companies with established market presence demonstrate lower risk of warranty default. Lead time commitments must account for both initial delivery and ongoing supply chain reliability throughout the product lifecycle.

Hidden Insights from 15 Years in the Battery Industry

Image Source: Consultancy.uk

Image Source: Consultancy.uk

Working with hundreds of manufacturers across fifteen years reveals industry insights that remain largely hidden from typical buyers. These lessons, often learned through costly setbacks, can dramatically impact battery procurement strategy.

Why dual-sourcing is critical in 2025

Single li ion battery supplier dependency has become a significant risk factor. Geopolitical tensions, tariff fluctuations, and supply chain fragmentation have made dual sourcing an essential strategy rather than contingency planning. This approach provides threefold benefits: risk diversification when factory disruptions occur, increased negotiation leverage with competing suppliers, and operational flexibility during unexpected tariff changes.

Automotive EV manufacturers have already implemented this strategy—contracting with multiple suppliers to ensure resilient upstream inputs. One effective approach pairs a global supplier (typically Chinese) with a nearshore partner, balancing cost efficiency with regulatory compliance.

Common mistakes buyers make

Inexperienced buyers typically overlook crucial factors beyond price considerations:

- Mismatching nominal battery voltage with inverter requirements (causing startup failures or inverter damage) • Ignoring BMS-to-inverter communication compatibility • Purchasing batteries without verifying safety certifications • Failing to consider future expandability (firmware upgradability, spare parts availability)

How to negotiate better supplier terms

Structure procurement agreements as “master agreements” with individual purchase orders—this provides flexibility while maintaining consistent terms. Fight for warranty terms that include performance testing during commissioning plus capacity, degradation, and efficiency guarantees.

Current market negotiations involve discounts ranging from zero to 2% off spot price indexes—significantly tighter than previous 5-10% reductions. Consider exploring tier-2 suppliers who often offer high-quality products with more favorable terms, particularly for purchases under 1GWh.

Use Cases: Matching Suppliers to Your Application Needs

Matching specific applications with appropriate li ion battery suppliers requires understanding the technical requirements that define performance in real-world conditions. Our experience developing custom battery solutions across diverse applications has shown how proper supplier selection directly impacts operational outcomes.

ESS: Home vs utility-scale

Residential battery storage systems typically range from a few kilowatt-hours to tens of kWh, often paired with solar panels. Utility-scale systems store electricity from megawatt-hours to gigawatt-hours. The key difference lies in deployment—home systems provide energy independence during outages, whereas utility installations stabilize grid fluctuations at substations.

The technical requirements differ significantly between these applications. Residential systems prioritize compact design, silent operation, and integration with existing electrical panels. Utility-scale installations demand high-capacity modules, sophisticated thermal management, and communication protocols for grid integration. Most utility-scale installations use LFP chemistry given its 2,000+ cycle performance coupled with thermal stability requirements for large-scale deployment.

Marine and RV: Compact and rugged packs

Marine and RV applications present unique environmental challenges requiring specialized engineering solutions. These systems must withstand constant vibration, temperature fluctuations, and potential water exposure. LiFePO4 batteries provide reliable performance across wider temperature ranges while maintaining efficiency under demanding conditions.

The engineering requirements for marine applications include corrosion-resistant terminals, waterproof enclosures rated to IP67 or higher, and vibration dampening systems. Dual-purpose batteries combining starting and deep-cycle capabilities offer operational flexibility for both engine cranking and powering onboard electronics. Space constraints demand compact designs under 9″ in dimension to ensure optimal space utilization.

Industrial: High-discharge and long cycle life

Industrial applications require battery systems capable of supporting high-power equipment with minimal maintenance intervals. LTO (lithium-titanium-oxide) batteries excel in these demanding environments, supporting 25,000+ charge/discharge cycles. These systems maintain 80% capacity even after 25,000 cycles—substantially outlasting standard lithium-ion alternatives.

The ability to fully discharge in approximately 3 minutes makes LTO technology particularly suitable for high-power industrial robots and equipment requiring rapid energy deployment. Temperature stability across -30°C to 55°C operational ranges ensures consistent performance in harsh industrial environments where battery replacement presents significant operational disruption.

Conclusion

Supplier selection has become the determining factor in battery project success. Our 15 years of custom battery development experience demonstrates that the lithium battery market’s expansion to $426.37 billion by 2033 creates both opportunities and complexities that require expert guidance to address effectively.

The chemistry shift toward LFP presents significant implications for procurement strategies. This transition offers cost advantages and safety benefits for many applications, but requires careful evaluation against specific performance requirements. Safety certifications including UN38.3, UL 1973, and IEC 62619 remain mandatory verification points that determine project viability and legal compliance.

The competitive landscape has consolidated around established manufacturers like CATL, BYD, and LG Energy Solution, while emerging companies such as SVOLT, EVE Energy, and Gotion provide alternative sourcing options. Each supplier category offers distinct advantages depending on application requirements and procurement volumes.

Dual-sourcing has become essential risk management rather than optional contingency planning. Companies relying on single suppliers face exposure to geopolitical tensions, tariff fluctuations, and supply chain disruptions that can halt production or dramatically increase costs.

Successful battery projects require three critical elements: precise chemistry matching to application requirements, thorough verification of supplier manufacturing capabilities, and comprehensive warranty terms that protect against performance degradation. These factors determine whether batteries perform reliably throughout their operational life or become costly liabilities.

The battery industry continues evolving rapidly through supply chain changes, chemistry advances, and application diversification. Partnership with experienced custom battery manufacturers provides essential expertise for understanding certification requirements, selecting appropriate chemistries, and ensuring manufacturing quality. This approach converts complex battery technology into reliable power solutions tailored specifically to application needs.

The companies that succeed in this market will be those that understand these technical realities and make informed decisions based on proven industry expertise rather than pursuing the lowest initial costs.

Key Takeaways

The lithium battery industry is experiencing explosive growth with critical shifts in chemistry preferences, supplier dynamics, and safety requirements that directly impact procurement decisions.

- LFP chemistry is rapidly gaining market share– Expected to reach 44% globally by 2025, offering superior safety and cost-effectiveness for ESS and RV applications over traditional NMC batteries.

- Dual-sourcing has become essential, not optional– Geopolitical tensions and supply chain disruptions make relying on single suppliers dangerously risky in 2025’s volatile market environment.

- Safety certifications are non-negotiable– UN38.3, UL 1973, and IEC 62619 standards must be verified before supplier selection to ensure legal compliance and operational safety.

- Chemistry selection must match application requirements– LFP for safety-critical applications, NMC for high energy density needs, and LTO where exceptional cycle life justifies premium pricing.

- Emerging suppliers offer competitive alternatives– Companies like SVOLT, EVE Energy, and Gotion provide viable options with favorable terms, particularly for specialized custom battery applications under 1GWh.

The battery market’s rapid evolution demands strategic supplier partnerships that balance cost, performance, and risk management. Success depends on matching the right chemistry to your specific application while maintaining supply chain resilience through diversified sourcing strategies.

FAQs

Q1. What are the key trends shaping the lithium battery market in 2025? The market is experiencing rapid growth, with a shift towards LFP chemistry gaining market share. There’s increasing demand for electric vehicles and energy storage systems, while top manufacturers like CATL and LG Energy are expanding production capacity globally.

Q2. How do LFP, NMC, and LTO battery chemistries compare? LFP offers superior safety and cost-effectiveness, ideal for energy storage. NMC provides high energy density, making it suitable for electric vehicles. LTO excels in fast charging and long cycle life, best for industrial applications requiring frequent cycling.

Q3. Why is dual-sourcing important when selecting battery suppliers? Dual-sourcing helps mitigate risks from geopolitical tensions, supply chain disruptions, and tariff changes. It provides increased negotiation leverage and operational flexibility, making it an essential strategy in today’s volatile market.

Q4. What certifications should I look for when evaluating a lithium battery supplier? Key certifications include UN38.3 for transportation safety, UL 1973 for stationary energy storage systems, UL 9540A for thermal runaway protection, and IEC 62619 for industrial applications. These ensure compliance with safety standards and regulations.

Q5. How can I negotiate better terms with lithium battery suppliers? Structure agreements as master contracts with individual purchase orders for flexibility. Negotiate for performance testing during commissioning and capacity guarantees. Consider tier-2 suppliers for purchases under 1GWh, as they may offer more favorable terms than larger manufacturers.